The 5 Reasons Why Accounting Software is the Game-Changer Your Agency Needs

Are you a Finance Manager facing spreadsheet struggles and communication issues in your creative agency? This blog reveals five reasons accounting software is essential with relevant market research data. Dive into the benefits of financial clarity, time savings, and improved cash flow management. Read on to transform your agency with finance management software now.

Reason 1: Financial Clarity and Decision-making. Unlocking Growth Opportunities

Say Goodbye to Excel Guesswork

According to a study by Ventana Research, 44% of businesses struggle with managing their financial data using spreadsheets like Excel. Accounting software can help you break free from spreadsheet limitations. This tool provides a clear, real-time overview of your agency's financial health and accurate information. You can confidently make well-informed decisions and open doors to new growth opportunities.

Foster Seamless Communication Between Departments

In a PwC survey, 50% of CFOs indicated that improving organisational collaboration is a top priority. Financial management tools for marketing firms facilitate team communication by offering a centralised platform to access and share financial information. This increased transparency eliminates misunderstandings resulting in more efficient and harmonious workflows.

Reason 2: Time Savings and Increased Productivity: Focus on What Matters Most

What are the Benefits of Streamlining Invoicing and Financial Operations?

A survey by Sage found that small businesses spend an average of 120 working hours per year on administrative tasks, including invoicing. Streamlining invoicing and financial operations through financial management tools designed for agencies offers several benefits. Here are five key advantages:

Reduced errors. Manual data entry can result in costly mistakes, such as duplicate or incorrect invoice amounts. Accounting software minimises these errors, improving client satisfaction and financial accuracy.

Faster payments. Automated invoicing streamlines the creation and delivery of invoices, ensuring prompt client payments and fostering a healthier cash flow.

Enhanced professionalism. Customisable invoice templates allow you to design professional, branded invoices that align with your agency identity. This polished appearance can positively impact your business reputation.

Better client management. Financial management tools record each job's billing history, payment terms, and contact information. This centralised information makes it easier to manage client accounts and address any billing concerns.

Simplify tax preparation. A streamlined invoicing process facilitates tracking taxable income and deductible expenses, leading to more efficient tax filing and potentially significant tax savings.

Save time and money by streamlining invoicing and financial operations with accounting software for creative agencies. As a result, your agency can focus on creative work while maintaining a healthy financial foundation.

Empower Your Team to Work Remotely

The global pandemic has accelerated the rise of remote work. A Gartner survey shows that 48% of employers plan to work remotely in the post-pandemic world, compared with 30% before. With cloud-based accounting software, your finance team can benefit from:

Access financial data anytime, anywhere.

Collaborate effectively with team members across locations.

Maintain productivity and efficiency even when working remotely.

Reason 3: Improved Cash Flow Management. No more Surprise

Why are Accurate Billable Hours Tracking and Project Costs Essential for Cash Flow Management?

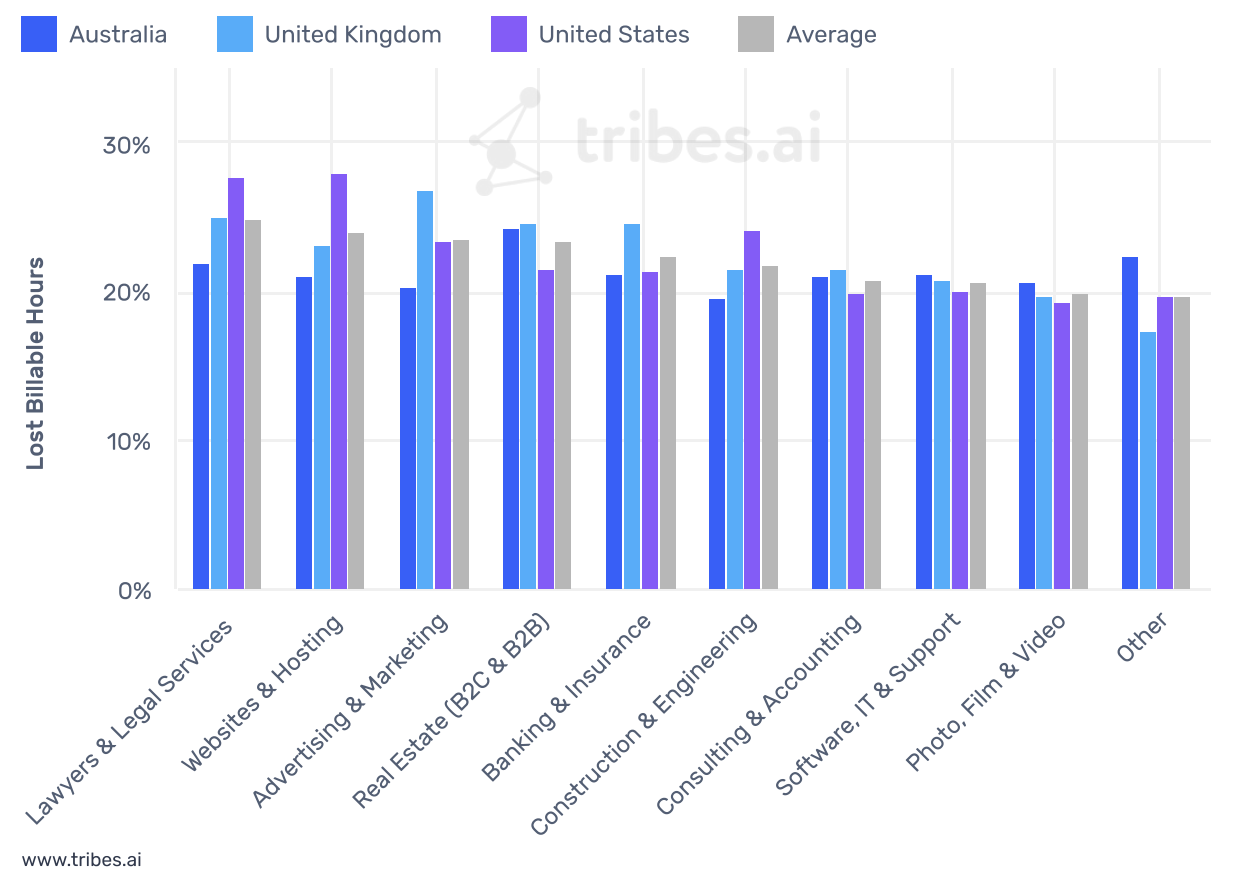

According to a survey by Tribes.AI, 21.3% of advertising and marketing executives said they experience revenue losses due to inaccurate billable hours tracking.

The best accounting solutions for design studios monitor billable hours and project costs precisely, allowing you to predict revenue fluctuations and plan accordingly. You'll never be caught off guard if you have the insights to maintain a steady cash flow and ensure long-term stability.

Proactively Monitor Client Budgets and Deadlines

Accounting software allows you to track project budgets and deadlines, ensuring that your agency delivers on time and within scope. By proactively managing these critical aspects of your client relationships, you can avoid costly overruns and maintain a strong reputation for reliability and professionalism.

Reason 4: Compliance and Risk Management: Peace of Mind Guaranteed

Audit Compliance and Report Generation Made Easy

The ACFE's 2020 Report to the Nations revealed that businesses lose an average of 5% of their annual revenue to fraud, often stemming from poor financial controls. With your agency's reputation on the line, ensuring compliance is crucial. An agency management system, like Pegasus Systems, simplifies this process by generating accurate financial reports and offering tools for tax preparation. This helps you stay compliant with regulations and safeguards your agency's reputation fostering trust among clients and partners.

Reason 5: Enhance Client trust with Transparent Financial Reporting

Showcasing Professionalism and Efficiency

In a 2019 study by TrustRadius, 45% of B2B buyers stated that transparency is a key factor influencing their purchasing decisions. Transparent financial reporting is crucial to building client trust and confidence. Accounting software helps you generate detailed and accurate financial reports for your clients, showcasing your agency's professionalism and efficiency while strengthening your relationships.

Improved Forecasting and Resource Allocation

Accounting software simplifies financial reporting and ensures you and your team make data-driven forecasts for future projects. By leveraging historical data and identifying trends, you can make informed decisions about resource allocation, pricing strategies, and project timelines. This proactive approach to financial planning will position your creative agency as a forward-thinking partner in your client's eyes.

“21.3% of advertising and marketing executives said they experience revenue losses due to inaccurate billable hours”

Pegasus Systems enhances professionalism and efficiency by providing real-time financial insights for informed decision-making, automating routine tasks like billing and invoicing, and streamlining financial management processes. By reducing manual work, our solution maximises profits and enables agencies to focus on growth and client relationships.

Time Savings Achieved Through Automating Invoicing Processes

To illustrate the time savings achieved through automating invoicing processes, we've created a chart comparing manual invoicing vs. accounting software like Pegasus software.

|

Task |

Time Spent (Manual Invoicing) |

Time Spent (Pegasus Accounting Software) |

|

Creating invoices |

4-6 hours/week |

1-2 hours/week |

|

Tracking payments |

2-4 hours/week |

30 minutes – 1 hour/week |

|

Resolving invoice discrepancies |

1-3 hours/week |

30 minutes – 1 hour/week |

|

Generating financial reports |

3/5 hours/week |

1-2 hours/week |

|

Total Time Spent |

10-18 hours/week |

3-6 hours/week |

Using accounting solutions can save your agency time.

Integration and Scalability: Accounting Software Grows with your Agency

Seamless Integration with Other Tools

Accounting software often integrates seamlessly with other essential tools and platforms your agency relies on, enhancing efficiency and productivity:

Project management. Automatically sync budget data and project timelines.

CRM (customer relation management). Faster invoicing with readily available client data. This helps populate the information into invoice templates with minimal effort.

Time-tracking. Simplify billing and monitor project progress.

This interconnected ecosystem streamlines data flow and reduces manual data entry, facilitating your team be productive.

Scalability for Your Growing Agency

As your creative agency grows and evolves, you need an accounting solution that can keep up. Modern accounting software is designed to be scalable, adapting to your needs as your client base expands and your projects become more complex:

Scalable accounting software can handle more transactions, clients, and users without compromising performance.

Offers modular or tiered pricing structures to add new features and capabilities as needed.

Ensures financial management processes remain robust and reliable as your agency reaches new heights.

Invest in the tools you need now without worrying about outgrowing your accounting solution in the future.

Move Your Agency to a Financial Management System!

Experience the transformative impact of the ideal accounting software, like Pegasus Systems, on your creative agency’s financial management. As a Finance Manager, you’ll benefit from enhanced communication, optimised operations, and better financial decision-making. After reading relevant market research data, you can make the right decisions for your agency’s growth. Don’t hesitate – unleash the potential of accounting software and witness your agency thrive! Secure your agency’s lasting success and profitability by taking charge of your financial management processes.